All of my code can be viewed on my Github: https://github.com/chaintuts

Featured Content

Code

All of my code can be viewed on my Github: https://github.com/chaintuts

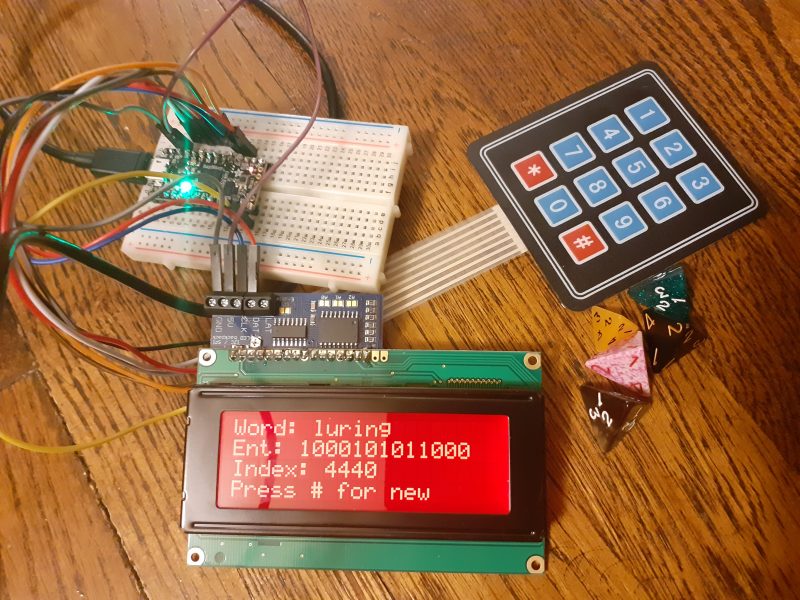

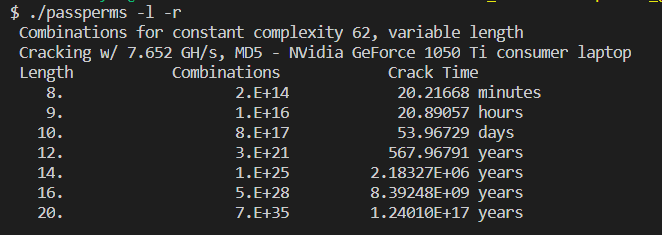

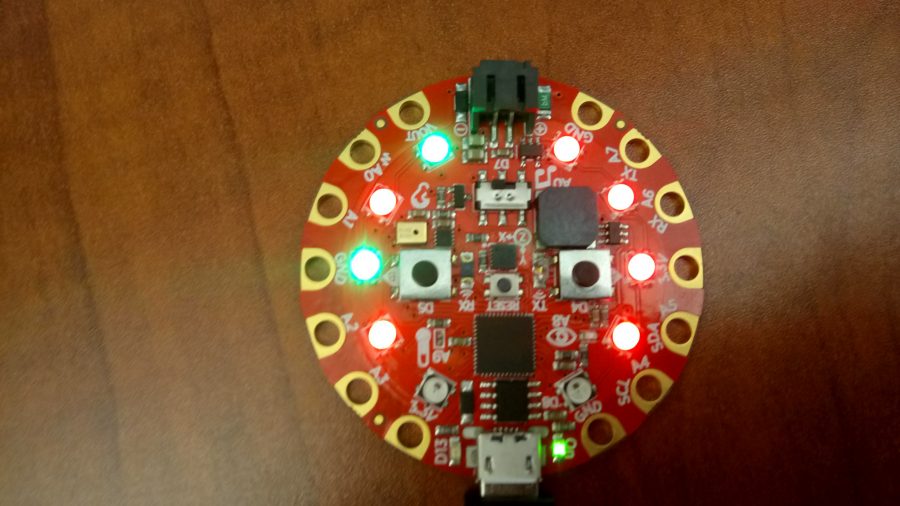

Many code projects with different technologies, covering everything from cryptocurrencies to cybersecurity to hobby interests and more!

This code: see repositories for detailed licenses. All projects use the BSD 2-clause License.Sharing and reuse (with attribution) is highly encouraged!

Videos

All videos are available under the CC-BY 4.0 license.Sharing and reuse (with attribution) is highly encouraged!

chaintuts Tech Education

My chaintuts Youtube channel link

Josh’s Active Adventures

My Josh’s Active Adventures channel link

Photos

All of my photos can be viewed on my Flickr page: https://flickr.com/joshmcintyre

All photos are available under the CC-BY 4.0 license.Sharing and reuse (with attribution) is highly encouraged!